Scenario Planning for Making Business Decisions

What is Scenario Planning?

Scenario planning is an advisory service that we offer at Back Beach Accounting under our Silver and Gold Plans. It involves proactive and forward-looking planning to map out the financial effects of business decisions before they are made. This article explores the purpose, benefits, and practical applications of scenario planning.

The Purpose of Scenario Planning

Scenario planning helps you understand the financial impact of potential business decisions. It allows you to map out the numbers and money involved in various scenarios, providing a clearer picture of the potential outcomes. This planning is crucial for making informed decisions about your business's future.

Benefits of Scenario Planning

The primary benefit of scenario planning is peace of mind. It helps you feel more confident about making decisions and knowing when to make them. By understanding the financial implications of different scenarios, you can take a more proactive role in your business and make product decisions with greater confidence.

Example 1: Spending on Advertising

As a first example, let’s talk about spending money on advertising. This is a common strategy in the increasingly digital world that we live in but you should expect that it’s a slow burn while you test out what type of ads are working and what brings in your customers.

When projecting out a scenario, you would expect that your expenses will increase in the short term (for a marketing specialist and an ads budget) but then to hopefully achieve sales that outweigh that in the mid term. But how long will I have to hold out until I break even, you ask?

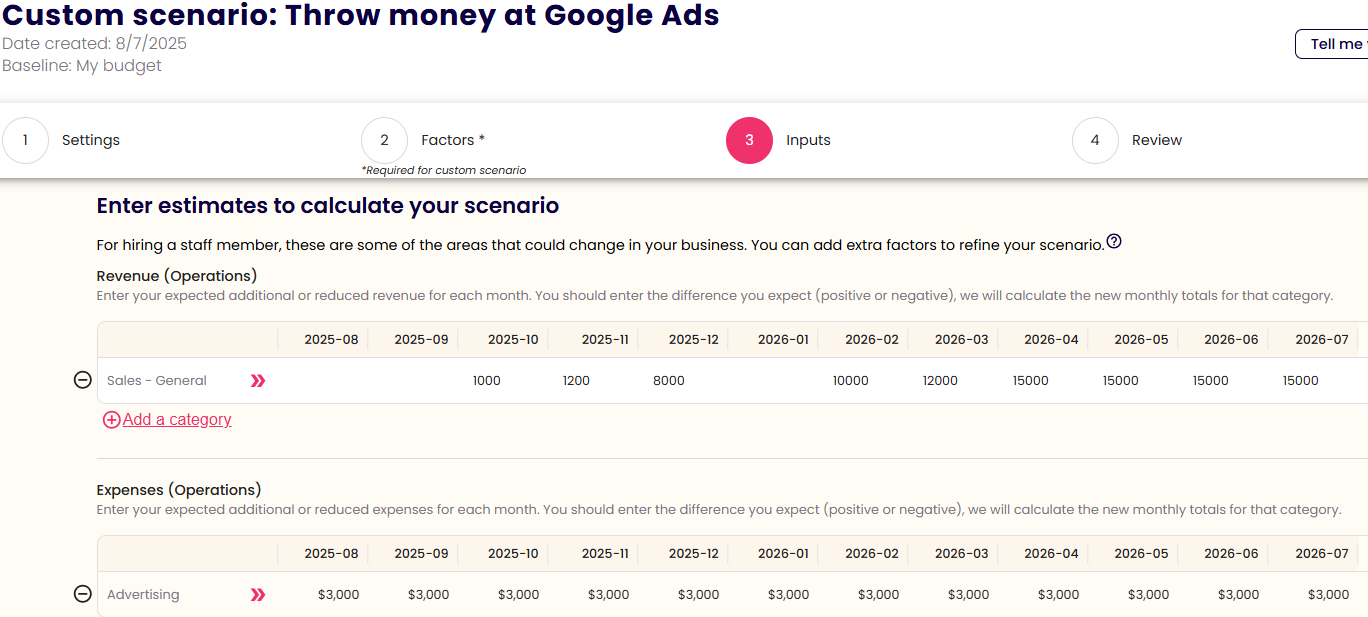

Let’s look at this example below, where we start spending $3,000/month and expect it to start bringing in small sales amounts after 2-3 months, slow down over the Christmas months and then increase up to a steady $15,000/month of sales:

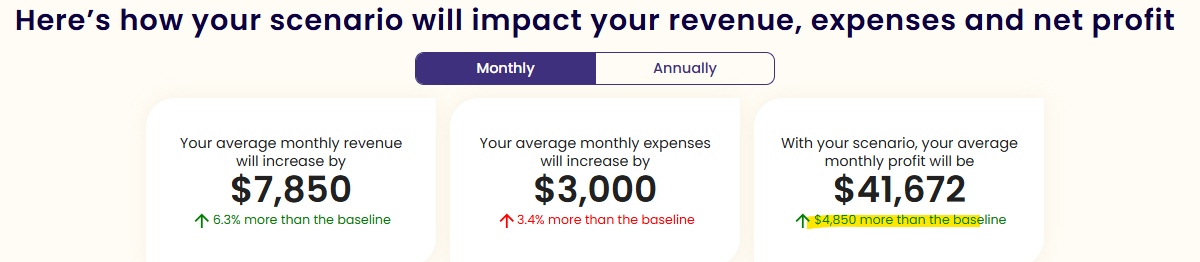

Through scenario planning, if our estimates are sensible, we can see that across the 12 months ahead, on average each month we’ll make $7,850 more sales, and only outlay $3,000 on expenses. This means an average profit of $4,850 each month by pursuing the advertising strategy!

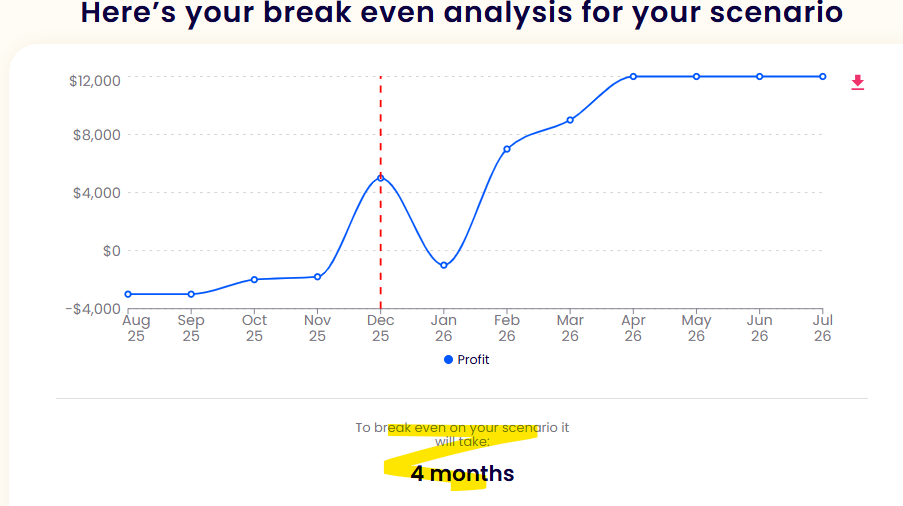

How long will it take before the strategy breaks even and starts to pay off? 4 months, as we can see through the break even analysis below:

As you can see, the simple exercise of scenario planning gives peace of mind before you commit and begin pouring out cash. It can be a hugely helpful tool in guiding your business to success.

Example 2: Hiring a New Employee

Another scenario involves deciding whether to hire a new employee. Scenario planning can help you estimate the costs of hiring, including one-off expenses and ongoing wages. It also allows you to project the potential revenue increase from the new hire and determine the breakeven point.

Example 3: Considering a Loan

One common scenario is deciding whether to take out a loan to fuel business growth. Scenario planning can help you map out the cash flow, potential purchases, and loan repayments. It allows you to determine the breakeven point and assess whether the loan is a worthwhile investment.

Example 4: Replacing a Vehicle

A fourth scenario might involve replacing a vehicle that is costly to maintain. Scenario planning can help you assess the financial impact of purchasing a new vehicle, including loan repayments and potential savings on repairs. It also allows you to evaluate whether the new vehicle will enable you to take on bigger jobs and increase sales.

Making Informed Decisions

Scenario planning helps you make informed decisions by providing a clear picture of the financial implications of different scenarios. It allows you to assess whether a decision makes sense financially and when the best time to make that decision is. For example, if hiring a new employee will result in a loss for six months, it might be better to wait until a period of higher cash flow.

Conclusion

Scenario planning is a valuable tool for business owners looking to make informed decisions. By mapping out the financial implications of different scenarios, you can gain peace of mind and confidence in your business decisions. If you're interested in learning more about scenario planning, consider reaching out to a professional who can help you use your existing financial data to project future outcomes.

At Back Beach Accounting, we're Xero certified advisors delivering ongoing fixed-price support to business owners in Coffs Harbour / the Gold Coast / Sydney / Brisbane and throughout Australia. We provide Xero training and customise Xero bookkeeping services for small to medium businesses, and are also able to cover your accounting and tax needs under the same roof (so that we can be as responsive as possible to your needs). Our team of Xero experts offer tailored Xero bookkeeping solutions to help you and your small business thrive. Contact us today to get expert help for your business.

Disclaimer: The material and contents provided in this article are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.

About the Author

Jack Dixon is a Chartered Accountant (CAANZ) and member of the Tax Practitioner’s Board (TPB). He holds degrees in both accounting and finance, and has career experience working internationally as well as in mid-tier accounting firms in Australia’s largest city. A move to regional NSW in 2018 gave Jack the opportunity to share his skillset with the local business community through establishing his very own progressive cloud accounting firm, Back Beach Accounting. Jack is an accounting technology enthusiast with a strong passion for helping business owners work smarter to give them back hours in their day.