Professional Bookkeeping Services: Should I consider a Xero Bookkeeper?

Introduction

As a business owner, you understand the importance of maintaining accurate financial records. Bookkeeping is essential for helping small to medium-sized businesses ensure that their financial data is organised and up to date. This is where Xero comes in. Xero is a powerful accounting software that simplifies bookkeeping tasks. But how do you know if you need a bookkeeper? In this blog, we will explore the signs that indicate you could benefit from hiring a bookkeeper, whether Xero is their area of expertise or not.

1. What Does a Bookkeeper Do?

Bookkeeping is the process of recording and managing your business’s financial transactions. A bookkeeper plays a crucial role in ensuring your small business runs smoothly. Here are the key responsibilities of a bookkeeper:

Recording Financial Transactions: Keeping track of all income and expenses.

Reconciling Bank Statements: Ensuring that your records match your bank statements (a process known as a bank reconciliation).

Managing Accounts Payable and Receivable: Tracking what you owe and what is owed to you.

Preparing Financial Reports: Generating reports that provide insights into your business’s financial health.

Accurate bookkeeping is vital for your small business. It allows you to make informed decisions, comply with regulations, and maintain financial stability.

Some people make the mistake of thinking that keeping the books up to date is just to satisfy tax authorities but really, you should do it regularly so that you have good information to make business decisions with.

2. How Do I Know My Small Business Needs a Bookkeeper?

Recognising when to seek professional bookkeeping services can be challenging. Here are some signs that indicate you may need one:

Overwhelmed by Financial Paperwork: If you find yourself buried in invoices and receipts and lacking time to focus, it might be time to get help.

Inconsistent Financial Records: Frequent errors or discrepancies in your records can signal the need for professional assistance.

Rapid Business Growth: Increased transactions due to growth can make it difficult to manage finances alone. Bookkeeping experts help your business avoid "growing pains" by putting in place solid accounting processes that scale with you.

Lack of Time: If bookkeeping takes time away from focusing on your core business activities, consider hiring a bookkeeper.

To assess your situation, ask yourself the following questions:

Do I struggle to keep my financial records organised?

Am I spending too much time on bookkeeping tasks?

Do I feel confident in my ability to manage my business’s finances?

If you answered yes to any of these questions, it may be time to consider hiring a bookkeeper.

3. Benefits of Engaging Professional Bookkeeping Services

A bookkeeper can provide numerous benefits to your business:

Time Savings: A bookkeeper can handle financial tasks, allowing you to focus on growing your business.

Cost Savings: Bookkeepers have cheaper hourly rates than other tax professionals. It is far cheaper to pay a bookkeeper than an accountant to correct the mistakes of DIY bookkeeping.

Improved Accuracy: Professionals ensure that your financial records are accurate and compliant with regulations.

Better Financial Insights: A bookkeeper can provide valuable insights, helping you make informed decisions.

Focus on Growth: With financial matters managed, you can concentrate on strategic planning and business development.

Peace of Mind: Knowing that a professional is handling your finances can reduce stress and anxiety.

Small business owners can gain a lot by investing in a bookkeeping firm, not least ongoing support.

4. Is a Bookkeeper the Same as an Accountant?

While bookkeepers and accountants both deal with financial information, they serve different purposes:

Bookkeepers: Primarily focus on recording and managing daily transactions. They ensure that your financial data is accurate and up to date.

Accountants: Analyse financials, prepare tax returns, and provide strategic advice. They often require a higher level of education and certification.

You may need both here and getting a great team together can make a huge difference in managing your business needs. A bookkeeper can manage day-to-day tasks, while an accountant can help with financial strategy and compliance. At Back Beach Accounting, we offer both service lines under the same roof.

5. How Much Do Bookkeepers Get Paid in Australia?

There's a range here - of course - but main factors which cause price differences are:

Experience: More experienced bookkeepers typically earn higher salaries.

Qualifications: Bookkeepers with certifications or specialised training may earn more eg. if they're a BAS Agent or member of a professional body such as The Institute of Certified Bookkeepers (ICB Australia).

Technologically Proficient: The smartest bookkeepers stay up to date with advances in their field and because of this, will be able to work faster, more accurately, and make things easier for you, There's a premium for this expertise. Tip: Xero accounting software is such a powerful and intuitive cloud-based solution and any fantastic bookkeeper knows this so will likely be a Xero advisor and able to provide Xero support when you have questions.

Location: Salaries may differ based on the cost of living in different areas.

A great bookkeeper will often score well on the factors above (and have a higher hourly rate) but they will save you time and money, both of which are extremely important when running a business. A cheaper bookkeeper will likely cause problems and cost you far more in the long term.

It's important to think of bookkeepers as more of an investment than an expense to your business.

6. Are All Bookkeepers the Same? Is Online Bookkeeping a Thing?

No, and Yes. In that order. Online bookkeeping is definitely a thing (we help clients all over Australia), but not all bookkeepers are the same.

Unfortunately, bookkeeping services can look like an easy job to do from home with little to no training required. So there are these kind of "bookkeepers" out there to be careful of.

Sometimes a family friend says they know how to use bookkeeping software and can do your business activity statements (BAS lodgements). What you need to understand is that knowing how to push a few buttons doesn't mean the information is right and this kind of help could actually be costing you a lot more than if you'd just hired a trained professional from the outset.

Fines and penalties can be severe for getting things wrong or missing due dates, the cost of your accountant re-doing things that were incorrect is far more expensive than simply paying for bookkeeper services, and finally, your business decisions are only as good as what has been entered into your xero software. It's important to get it right!

Expert bookkeepers will stay across the latest technology that can save you time, understand GST well in order to save time/cost of your accountant and be able to streamline your data entry so that you can focus on what matters - growing profits!

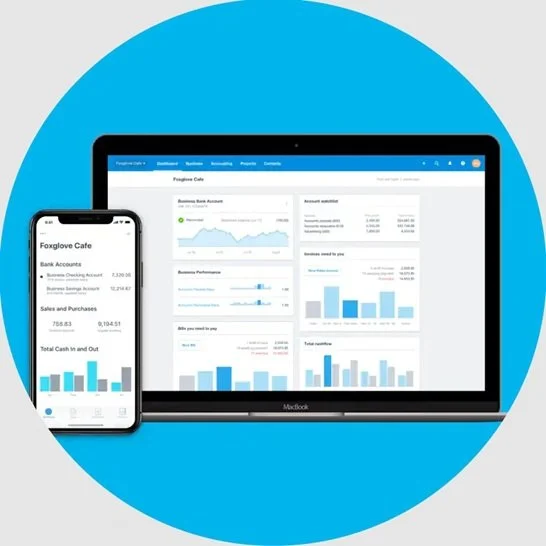

7. I use Xero Accounting Software. Should I Look for a Xero Bookkeeper?

If you're already using Xero for your business, hiring a bookkeeper familiar with the software is advantageous. Here are some reasons to consider professional Xero bookkeeping services:

Streamlined Processes: They'll get the settings right and can help you maximise the software’s features, making your bookkeeping more efficient.

Integration: They can ensure that Xero integrates smoothly with your other cloud-based business systems.

Expertise: A certified Xero bookkeeper will be well-versed in the software’s updates and best practices.

Working with a Xero-specialist bookkeeper means they'll be able to help really easily with your Xero bookkeeping needs. When it comes to Xero, great bookkeepers offer expertise in all sorts of other online bookkeeping solutions such as automating expense payments and record keeping, simplifying payroll needs and giving you better visibility over cashflow. If you weren't already aware, Xero offers all sorts of easy-to-browse information about these solutions in the Xero App Store.

8. What Should I Look for in a Great Xero Bookkeeping Service?

When searching for a bookkeeper, consider these key qualities:

Attention to Detail: Accuracy is essential in bookkeeping.

Strong Communication Skills: Your bookkeeper should be able to explain financial information clearly.

Proficiency in Xero: Ensure they are Xero certified or at least skilled in using Xero for your bookkeeping needs. Great bookkeepers know that Xero sets the bar for bookkeeping software these days.

Good References: Look for reviews or testimonials from previous clients.

Professional Certifications: Check for relevant qualifications and ongoing education.

When making enquiries, ask questions that assess their experience and approach to bookkeeping.

Conclusion

Hiring an experienced Xero bookkeeper can significantly impact your business’s success. Accurate financial management is crucial for growth and stability. If you find yourself struggling with bookkeeping tasks, it may be time to consider hiring a professional.

At Back Beach Accounting, we're Xero certified advisors delivering ongoing fixed-price support to business owners in Coffs Harbour / the Gold Coast / Sydney / Brisbane and throughout Australia. We provide Xero training and customise Xero bookkeeping services for small to medium businesses, and are also able to cover your accounting and tax needs under the same roof (so that we can be as responsive as possible to your needs). Our team of Xero experts offer tailored Xero bookkeeping solutions to help you and your small business thrive. Contact us today to get expert help for your business.

Disclaimer: The material and contents provided in this article are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.

About the Author

Jack Dixon is a Chartered Accountant (CAANZ) and member of the Tax Practitioner’s Board (TPB). He holds degrees in both accounting and finance, and has career experience working internationally as well as in mid-tier accounting firms in Australia’s largest city. A move to regional NSW in 2018 gave Jack the opportunity to share his skillset with the local business community through establishing his very own progressive cloud accounting firm, Back Beach Accounting. Jack is an accounting technology enthusiast with a strong passion for helping business owners work smarter to give them back hours in their day.